Fighting Seizures by U.S. Secret Service

If your property was seized by the United States Secret Service (USSS) for forfeiture pursuant to Title 18 USC 981, the USSS might allege the property was used in an illegal scheme for money laundering, drug trafficking, fraud, or another federal crime.

After your property is seized, the U.S. Secret Service has 60 days to send you the “Notice of Seizure” letter that explains the legal basis for the seizure and forfeiture. The letter comes from the “U.S. Department of Homeland Security” (DHS) because the United States Secret Service is an operational and support component of DHS.

Sometimes, a third party might send you written notice concerning funds seized from your bank account. For example, we recently saw a notice from Chase Bank that provided:

“Please respond to the U.S. Secret Service to pursue seized property. We’re following up on an email you received recently from the U.S. Secret Service (USSS) about funds it seized from your Chase account ending in XXXX, which has been closed.

As stated in the email, the seized funds were subject to forfeiture pursuant to Title 18 USC 981 as properies that were used in violation of Title 18 USC 1343….

If you disagree with the seizure and seek to contest it in U.S. District Court, you must file the “Seized Asset Claim Form” attached in the email…. If you have any questions, please contact the USSS.”

In addition to banks and financial institutions, the U.S. Secret Service seizes cryptocurrency from Binance, Blockfi Trading, Coinbase, Metamask Wallet, Remitano, Trezor Wallet, and other cryptocurrency and digital currency exchange businesses.

Most seizures for forfeiture by U.S. Secret Service involve the following types of assets:

- U.S. Currency;

- bank account or credit union account;

- clearing service or brokerage services account;

- corporation account;

- teller’s or cashier’s check;

- Western Union Money Order;

- Visa prepaid debit card or debit gift card;

- US bank cashier’s check;

- Venmo Account;

- Paypal Account from PayPal Holdings, Inc.; or

- Cryptocurrency

- Bitcoin or Tether from Binance | Binance Holdings Limited;

- Bitcoin, Ethereum, or Uniswap from Blockfi Trading Account;

- ApeCoin, Bitcoin, Chainlink, Polkadot, or Tezos from Coinbase;

- Ether from Metamask Wallet;

- Bitcoin, Ethereum from Remitano Account; or

- Bitcoin, Ether from Trezor Wallet.

Seizures by the U.S. Secret Service tend to focus on payment and financial systems from criminal exploitation and counterfeit currency. Forfeitures for cybercrime often involve ransomware, computer network breaches, bank and wire fraud, and credit card fraud.

Attorney for Forfeiture by USSS

Attorney Leslie Sammis fights seizures for civil asset forfeiture by the U.S. Secret Service throughout Florida. She works with local attorneys on cases throughout the United States. If you are an attorney with a USSS forfeiture case, contact Leslie Sammis about co-counseling.

We represent the owner of the bank or cryptocurrency account, the person from whom the property was taken, third-party owners, bonafide purchasers, lien holders, sellers for value, or a victim of fraud.

If the U.S. Secret Service gave you notice that your U.S. Currency, cryptocurrency, bank account, or other valuable property was seized for forfeiture in accordance with Title 18, U.S.C., Section 981, then contact us about the benefits of filing a verified claim for court action in the U.S. District Court.

Filing that verified claim triggers a 90-day deadline for the agency to either RETURN 100% of the money or cause an Assistant United States Attorney (AUSA) to file a complaint for forfeiture in the U.S. District Court.

Filing a verified claim with the U.S. Secret Service is the ONLY way to contest the forfeiture of the property in U.S. District Court. The U.S. Secret Service must receive the claim in hand by that deadline.

When you call us, we can explain why demanding court action is much better than filing a petition for remission or mitigation. The administrative forfeiture proceedings for remission or mitigation rarely work, so demanding court action is better.

If you miss that deadline for demanding court action, the government will probably get to keep the property forever.

To find out more, call 813-250-0500.

USSS Notice of Seizure Letter

Within 60 days of the seizure, the United States Secret Service (USSS) is required to send a “notice of seizure” form that gives you the following three options:

- You may agree to the forfeiture by petitioning the USSS for the return/remission of the forfeited property after submitting the Petition for Remission/Mitigation” Form (these petitioners are often denied months later with a form letter).

- You may disagree with the forfeiture and contest it in the United States District Court by filing a claim with the attached “Seized Asset Claim Form” (this is the ONLY way to contest the seizure and the best way to fight for 100% of your money back); or

- You may have no interest in this property and, therefore, do not need to respond to the letter.

The notice lists the agency case number, secure number, asset identification number, asset description, and asset value. The letter describes the property seized for forfeiture by the United States Secret Service (USSS), along with the date and location of the seizure.

The letter explains that items subject to forfeiture pursuant to Title 18 U.S.C. 981 are properties that were used in or acquired by a violation of Title USC 1343. In addition to mailing a personal notice, the Secret Service must publish details about the seizure online.

How to Get the Money Back for U.S. Secret Service

Our attorneys can help you prepare the verified claim form and deliver it to the Secret Service Asset Forfeiture Division at the address listed in the notice. Click here to find a sample verified claim form.

The verified claim for court action, hardship petitions, and/or petitions for remission or mitigation must be sent to the address listed in the notice, which might include the following:

U.S. Secret Service (USSS)Communications Center – AFD

Attention: Secret Service Asset Forfeiture Division

245 Murray Lane, SW Building T-5

Washington, D.C. 20223

Phone: (202) 406-7222

If you disagree with the USSS that the property is subject to forfeiture, you can demand that it be returned immediately by filing the claim. Filing the claim triggers a 90-day deadline for an Assistant United States Attorney (AUSA) to either:

- decline to file a complaint for forfeiture and instead instruct the agency to return the property to you; or

- file a complaint for forfeiture in the U.S. District Court.

Attorney Leslie Sammis can help you challenge the USSS seizure for forfeiture by filing a claim of ownership using the attached “Seize Asset Claim Form” by the date referenced in the letter.

You should ensure that correspondence regarding the USSS seizure with intent to forfeit references the seizure number provided in the letter. documents should be submitted to the following address via commercial carrier (e.g., FedEx, DHL, UPS). On the seized asset claim form, your attorney will provide your name, address, phone number, seizure number, case number, and city and state of seizure.

In Part I, your attorney will list the item or items in which you are making a claim. Your attorney should include sufficient information to identify the items, such as serial numbers, make and model numbers, tail numbers, photographs, etc.

In Part II, your attorney will explain your interest in each item of property listed in Part I. The form also provides an option for your attorney to provide documents supporting the claim, although that is not required.

In Part III, you are required to sign the attestation and oath personally. The form provides:

I attest and declare under penalty of perjury that my claim to this property is not frivolous and that the information provided inn support of the claim is true and correct, to the best of my knowledge and belief.

The form explains that a false statement or claim may subject a person to prosecution under 18 USC Section 1001 and/or 1621 and is punishable by a fine and up to five years imprisonment.

Letter from Homeland Security Acknowledging Claim

After filing a claim to contest the seizure for forfeiture, the U.S. Department of Homeland Security will send your attorney a “claim receipt” signed by the Special Agent in Charge (Acting) in the Criminal Investigation Division.

The letter from the U.S. Department of Homeland Security lists the judicial district, the agency case number, the seizure number, the asset identification, the asset description, and the asset value.

The letter acknowledges the date the claim was filed and received by the U.S. Secret Service and that the matter will be referred to the United States Attorney’s Office for the appropriate district court.

The letter might provide the name of the Assistant United States Attorney (AUSA) assigned to the case. The AUSA decides whether to file a complaint for forfeiture in the appropriate United States District Court and might also negotiate a settlement to avoid additional litigation.

After filing a verified claim, we can help you demand the immediate release of the seized property by filing a hardship petition in accordance with 18 U.S.C. §983(f).

The USSS Asset Forfeiture Manual

The United States Secret Service uses its Asset Forfeiture Manual to guide enforcement actions regarding liquidated damages, penalties, fines, and seizures.

The Department of Homeland Security has three components with seizure and forfeiture authority, including the United States Secret Service (USSS), the U.S. Customs and Border Protection (CBP), and the U.S. Immigration and Customs Enforcement (ICE).

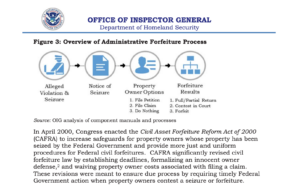

As explained in the USSS Asset Forfeiture Manual, after the property is seized, the USSS, through the DHS, must send the property owner and any other parties that may have an interest in the property a written notice of the seizure and intent to forfeit. The notice explains the options to file a petition or claim, or do nothing.

Property owners might file petitions if they agree their property is subject to forfeiture but are seeking its partial or full return. Filing the petition and using the administrative proceeds rarely results in the property’s return.

The better court of action is to file a claim for court action, which is the ONLY way to force the speedy return of the property or contest the seizure in court when the property owner believes the initial seizure was illegally conducted. The claim is also the only way to contest whether the government has enough proof that the property was involved in illegal activity.

Release of Property to Avoid Substantial Hardship

If you choose to contest the forfeiture and file a Claim of Ownership using the Seized Asset Claim Form as set forth above, you may be entitled to immediate release of the U.S. Department of Homeland Security UNITED STATES SECRET SERVICE seized property if:

- You have a possessory interest in the property;

- You have sufficient ties to the community to provide assurance that the property will be available at the time of the trial;

- You show that the continued possession by the Government pending the final disposition of forfeiture proceedings will cause you substantial hardship;

- You show that your likely hardship from the continued possession by the Government of the seized property outweighs the risk that the property will be destroyed, damaged, lost, concealed, or transferred if it is returned to you during the pendency of the proceedings;

- The property is not contraband, evidence of a violation of a law, currency, or currency, or other monetary instruments, or electronic funds unless such other monetary instrument or electronic funds constitutes the assets of a business that has been seized;

- The property is not, by reason of design or other characteristics, particularly suited for use in illegal activities;

- The property is not likely to be used to commit additional criminal acts if returned to you.

A claimant seeking the release of property must file a request for Possession of the Property with the Deputy Assistant Director of the USSS’s Office of Investigations at the address listed in the notice. A request for Possession of the Property must set forth the basis on which the requirements listed above are met.

If the property is not released within fifteen days after the USSS receives a request for Possession of the Property, the claimant may file a petition for the release of the property in the district court in which the seizure warrant was issued or in the district court for the district in which the property was seized.

The notice might explain that you should ensure that any correspondence regarding this matter references the Seizure Number provided in the notice. The notice might also suggest that all documents be submitted to the following address via commercial carrier (e.g., FedEx, DHL, UPS).

Problems with USSS Petitions for Remission or Mitigation

Contact us to discover the problems with filing a Petition for Remission or Mitigation of the Forfeiture with the U.S. Secret Service. Those administrative procedures often result in NO MONEY being returned at all.

By filing a petition for mitigation or remission, you stipulate that the seizure was lawful and that you do NOT want to contest the forfeiture. Instead, by asking for remission or mitigation, you are only allowed to ask for a portion of the property to be returned and only if you have proper documentation of your interest in the property, including facts and circumstances justifying the return of the property.

Even with the proper documentation, the USSS might deny your request by sending a form letter several months later. If you have any grounds to contest the seizure, you should do so by demanding court action (instead of using the less effective administrative proceedings for remission or mitigation).

If you file a claim, your attorney may request information showing your interest in the property supported by bills of sale, contracts, mortgages, or other documentary evidence. Your attorney might also ask you explain the following facts and circumstances that are otherwise required in a petition:

- With respect to a property interest in existence at the time the illegal conduct giving rise to forfeiture took place, a petitioner must establish the following:

- a legally cognizable property interest in the seized property; and

- no knowledge of the conduct giving rise to the forfeiture; or

- upon learning of the conduct giving rise to the forfeiture, the petitioner did all that reasonably could be expected under the circumstances to terminate such use of the property.

- With respect to a property interest acquired after the conduct giving rise to the forfeiture has taken place, a petition must establish:

- a legally cognizable property interest in the seized property;

- at the time the property interest was acquired, that the petitioner was a bona fide purchaser or seller for value; and

- that the petitioner did not know and was reasonable without cause to believe that the property was subject to forfeiture.

- A petitioner who cannot establish a property interest in the property may obtain remission or mitigation of the forfeiture if the petition establishes that:

- a pecuniary loss of a specific amount has be n directly caused by the criminal offense, or related offense, that was the underlying basis for the forfeiture supported by documentary evidence, including invoices and receipts;

- the pecuniary loss is the direct result of the i legal acts and is not the result of otherwise lawful acts that were committed in the course of a criminal offense;

- the victim did not knowingly contribute to, participate in, benefit from, or act in a willfully blind manner towards the commission of the offense, or related offense, that was the underlying basis of the forfeiture;

- the victim has not, in fact, been compensated for the wrongful loss of the property by the perpetrator or others; and

- the victim does not have recourse reasonably available to other assets from which to obtain compensation for the wrongful loss of the property.

USSS’s Cares Act Notice of Seizure for Forfeiture

The United States Secret Service has begun devoting significant resources to seizing funds from bank accounts based on allegations of fraudulently obtained PPP loans and fraudulently obtained COVID-19 Economic Injury Disaster Loan (EIDL) loans related to the Cares Act.

For example, if funds are deposited into a Bank of America or Chase Bank Account related to an ACH deposit from SBAD TREAS 310 for an EIDL loan. The bank statement might later list withdrawal for any funds remaining in the account.

The notation on the bank statement might be listed as a “Debit DDA – Check Charge.” The bank might close the account and send you a written notice that the USSS seized the funds.

In those cases, the personal notice letter from the USSS will allege that the money seized from a bank account is subject to forfeiture pursuant to Title 18 USC 981 as properties used in or acquired by violation of Titles 18 USC 1343 (wire fraud) or 18 USC 1014 (loan or credit application fraud). These notices invite you to contact caresact.noticing@usss.dhs.gov.

We have asked the following question: If funds were seized by USSS and those funds can be traced to proceeds from a PPP or EIDL loan, can the seized funds be sent back to the SBA to pay the debt instead of being subjected to civil asset forfeiture?

In at least one instance, an Assistant United States Attorney (AUSA) in an Asset Recovery Division told us that it is not possible to bypass the forfeiture procedure and return these funds directly to SBA. In some cases, the banks could reverse the transfer and send funds back to the SBA if the amount of funds was the full amount of the loan sent.

In cases where it was not, the government had no option except to seize the funds. As SBA does not have seizure authority, they could not effectuate the seizure. Instead, another agency has to seize the funds.

Thus, all of these funds have to be either forfeited or returned to the person from whom they were seized. After the funds are forfeited, the agency that seized them MIGHT be able to get them back to the SBA through the petition process. That said, SBA is receiving updates on all of these claims and is aware of the status of the litigation.

SBA might tell you:

In response to your recent inquiry regarding Disbursement of Funds/Loan Amount for Loan #____ /Application #_____, the Small Business Administration is unable to proceed with any requests or assistance until the United States Secret Service (USSS) Seizure has been remedied on your behalf. Please, refer to your seizure notice or banking institution for more information, and contact the appropriate authorities to resolve the issue/seizure. Until the SBA receives the seized funds, we are unable to make any adjustment to the loan balance. Seizure amounts will be visible in your CAFS account when received. Until then, the Full Loan amount and payments remain due according to the current payment schedule.

Covid EIDL Servicing Department

833-853-5638

covideidlservicing@sba.gov

What can you do if those SBA loan funds were seized from your account? If you were entitled to a personal written “notice of seizure” that should have been mailed to you but you never received it in time to file a claim for court action, then you have 5 years to file a “Motion To Set Aside Forfeiture under 18 U.S. Code § 983.” The lawsuit is served on:

Director, U.S. Secret Service

U.S. Secret Service Headquarters

245 Murray Lane, S.W.

Building T-5

Washington, D.C. 20223

Steps to Set Up a Consultation with an Attorney

If you want to set up a consultation with an attorney, take these steps:

- The first step is to find the notice published on the forfeiture.gov website.

- What if you can’t find the published notice and never received a personal notice of seizure? At Sammis Law Firm, we keep an electronic copy of all such published notices of seizure going back five (5) years.

- To schedule the consultation, please email us a request to Tammy@sammislawfirm.com explaining your name and contact information, what property was seized and when, whether you received a personal notice or found the published notice on forfeiture.gov, and what you did in response as far as filing a claim or petition.

- When we receive the email, we will contact you to set up a consultation with an experienced civil asset forfeiture attorney.

Additional Resources

Official Notifications of Seizures for Forfeiture by the Secret Service – Visit the government website to find a list of cases published in a pdf in which federal agents with the Secret Service have seized valuable property, including U.S. Currency and funds from bank accounts. The official notification includes information about how to file a demand for court action and judicial referral.

Finding a Lawyer for USSS Seizures for Forfeiture

Suppose you are identified as an interested party or the possible owner of seized property, including U.S. currency or the money in a bank account. In that case, you will receive personal notice in the form of a letter from the United States Secret Service (USSS) and the U.S. Department of Homeland Security (DHS).

We can help you respond to any letter or email from the U.S. Secret Service regarding funds seized from your bank account for forfeiture pursuant to Title 18 USC 981.

The letter will often claim that the funds from the bank account were subject to forfeiture under Title 18 USC 981 as properties that were used or acquired in violation of Titles 18 USC 1343 (wire fraud) and 18 USC 1014 (loan and credit application fraud).

After receiving the seizure notice and intent to forfeit from the U.S. Secret Service, act quickly to protect your rights. Contact a civil asset forfeiture attorney at Sammis Law Firm to discuss the case. We can help you determine how to claim and protect seized property during a forfeiture proceeding. Find out why petitions for remission and mitigation don’t typically work.

Our attorneys can ensure that your claim meets the requirements outlined in 18 U.S.C. 983(a)(2)(C) and is properly filed with the Secret Service Asset Forfeiture Division by the date indicated in the notice. We can also gather evidence to show that the initial seizure was ILLEGAL or that insufficient evidence exists to support the forfeiture action.

After a seizure of money, bank accounts, or other property, the attorneys at Sammis Law Firm represent owners, lien holders, bonafide purchasers, sellers for value, or victims of fraud.

If you received a notice of seizure of property and initiation of administrative forfeiture proceedings from the United States Secret Service, call 813-250-0500.

This article was last updated on Friday, September 13, 2024.