Case Results in Civil Asset Forfeiture Cases

We represent clients after their cash is seized for civil asset forfeiture proceedings in Florida and across the county. Many of these seizures occur at airports, bus stations, train stations, or on the roadway. More and more of our cases are involving the seizure of cryptocurrencies.

When someone calls our office for a consultation, they often ask, “What kinds of cash seizure for forfeiture cases have you taken in the past, and what was the outcome in those cases?” We maintain this list of recent civil asset forfeiture case results to answer those questions.

If you would like to view the case results listed below, then you should read the following disclaimer:

- The Florida Bar does not approve or routinely review case results posted by attorneys.

- The facts and circumstances of your case may differ from the facts and circumstances discussed here.

- Not all case results are listed here or provided.

- The case results discussed here are not necessarily representative of the results obtained in all cases.

- Each case is different and must be evaluated and handled on its own merit.

Click here to read more about how we handle civil asset forfeiture cases involving a cash seizure.

Click here for a separate list of case results for vehicle seizure for forfeiture.

Court Orders the Return of $500,000 of Cryptocurrency Seized by a Florida Sheriff’s Office

On June 17, 2025, the Honorable J. Layne Smith, Circuit Judge in Wakulla County, FL, ordered the sheriff’s office to return the seized cryptocurrency, including over $500,000 worth of Bitcoin (BTC), to our client. Shortly after the cryptocurrency was seized and our law firm was retained, we filed a demand for an adversarial preliminary hearing (APH) on the Florida Attorney General’s Office as required by the notice of seizure. An all-day adversarial preliminary hearing was held on June 11, 2025. After the hearing, the Court entered an order finding:

At the beginning of the adversarial preliminary hearing, Ms. Sammis handed the Court a copy of the claimant’s motion to dismiss and memorandum of law that she had filed that morning. The Court reviewed the motion prior to the start of the evidentiary hearing. The Court took the motion under advisement and proceeded with an all-day adversarial preliminary hearing.

[The Court found that because the cryptocurrency account was never located in Wakulla County, FL,] per Florida Statute Section 30.15(1), the sheriff’s office lacked the authority to seize property in another county….Wherefore, the Court dismisses this action for lack of subject matter jurisdiction. The Court orders the petitioner to return the seized account to the claimant.

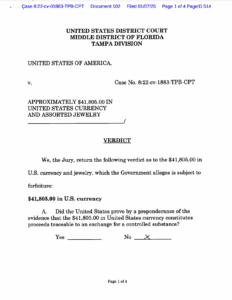

Complete Victory in Jury Trial After DEA Seizes $41,805.00 and About $30,000 in Gold Jewelry

On January 6-7, 2025, Attorney Leslie Sammis took a civil asset forfeiture case to trial in federal court before the Honorable Judge Thomas Barber. The Drug Enforcement Administration (DEA) seized $41,805.00 and about $30,000 in gold jewelry. The property was seized in Manatee County during the execution of a search warrant at our client’s home in late 2021. The case was stayed while the criminal charges were pending. The two-day trial happened on Monday and Tuesday. The jury checked all 9 boxes, “No,” which means the government must return all seized property. It was a total and complete victory.

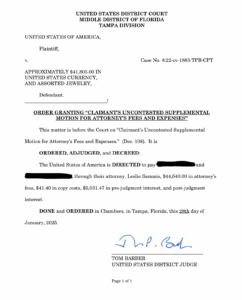

On January 28, 2025, the Court signed an order directing the government to pay the Claimants, through their attorney Leslie Sammis, $44,640.00 in attorney’s fees, $41.40 in copy costs, $5,031.47 in pre-judgment interest, and post-judgment interest. The U.S.A. was required to pay all the Claimant’s reasonable attorney fees, which is mandatory under the Civil Asset Forfeiture Reform Act of 2000 (CAFRA). The mandatory attorney fees provisions are intended to discourage overzealous Government actions in forfeiture cases.

Court Finds No Probable Cause for Seizure by Lake County Sheriff’s Office

Leslie Sammis represented two clients (the company that loaded money into an ATM and the bank that supplied the money to the company). In that case, the Lake County Sheriff’s Office seized $42,423,00 in U.S. Currency from one ATM and $89,407 from another ATM. After an Adversarial Preliminary Hearing held on October 4, 2024, the Court reviewed exhibits, watched a video of the seizure, and listened to the testimony of several witnesses. In an order dated October 4, 2024, Circuit Court Judge Dan R. Mosley found that the Lake County Sheriff’s Office had “no probable cause” to seize the currency found in the ATMs. The property was returned to Ms. Sammis’ clients shortly thereafter.

CBP Releases 1992 Land Rover Defender 110 Imported from South Africa

On April 10, 2024, we received a letter from Robert M. Del Toro, Fines, Penalties and Forfeiture Officer, signed by Rebecca Gabbard, CBP Paralegal Specialist, explaining that our client’s 1992 Land Rover Defender 110, imported from South Africa, seized on 9/20/23, was being returned. The letter explained that the “Government has decided to release the property to you and return the cost bond.” The letter gave further instructions on picking up the vehicle from a government-contracted facility where it was being held. Before receiving this letter, we filed a non-CAFRA claim for court action, posted the cash bond, and negotiated with the Assistant United States Attorney (AUSA) while explaining why CBP’s allegations were wrong. Ultimately, the AUSA refused to file a complaint in the U.S. District Court, forcing CBP to release the vehicle immediately.

DEA “Quick Release” under 28 CFR 8.7

On February 6, 2024, more than $20,000 in U.S. Currency was seized for forfeiture at the Jacksonville International Airport. The client hired us the next day. On February 8, 2024, we sent a preservation letter and public record request to the Department of Aviation Security or Internal Auditor at the Jacksonville Aviation Authority (JAA). The letter was to obtain any airport surveillance video showing our client’s initial detention before he was moved to an interrogation room where his luggage was searched and his money was seized. The client also reported that the DEA task force officer seized his cell phone and attempted to delete a video he had taken during his initial detention.

Instead of releasing the surveillance video, the Internal Auditor at JAA forwarded our request to Bradley A. Boyle, Group Supervisor, DEA Jacksonville District Office. Possibly because they didn’t want the video released, the seizing agents indicated they might be willing to release the money if we provided additional documents. We were later contacted by Special Agent John Hollingsworth, DEA Jacksonville District Office, who requested our client sign a DEA-48 (Disposition of Non-Drug Evidence) and Secured Party Indemnity Agreement. That agreement falsely claimed the money had been used in violation of Title 21 of the United States Code. It included a “hold harmless” provision that would have protected DEA from further liability. That proposed agreement also contained language that would have precluded any innocent owner/lienholder defenses if the money were seized again.

When we refused to sign those documents, we received an email from Merri Hankins, Senior Attorney in DEA’s Asset Forfeiture Section, who clarified that “DEA is attempting to return your client’s funds per a procedure referred to as ‘quick release’ found in 28 CFR 8.7.” The quick release was approved even though we had already filed a premature claim on the client’s behalf with DEA on February 20, 2024.

After some negotiation, DEA allowed the client to retrieve all of his money from the sealed evidence bag on March 1, 2024, without signing any of the agreements prepared by DEA.

Court Finds “No Probable Cause” at Adversarial Preliminary Hearing in Broward County

On November 2, 2023, the Honorable Michael Robinson, a Circuit Court Judge in Broward County, signed an order finding “no probable cause” for the seizure and forfeiture of a 2020 Dodge Challenger after an adversarial hearing held on October 30, 2023. The order required the agency to return the vehicle to our client within five (5) business days. Additionally, the order found that since there was no probable cause, the Hollywood Police Department, pursuant to Section 932.704(10), was ordered to reimburse the client for the reasonable attorney fees paid to our firm.

DEA Releases Seized Vehicle After Arrest While Charges Pending

On September 8, 2023, a 2014 Mercedes-Benz G550 was seized by the Drug Enforcement Administration (DEA) during a routine traffic stop, alleging a violation of 21 USC 881, along with violations of other federal laws, including 19 U.S.C. §§ 1602-1619, 18 U.S.C. § 983 and 28 C.F.R. Parts 8 and 9. On behalf of the client, Sammis Law Firm filed a claim for court action with DEA. We presented arguments regarding an illegal stop, detention, and arrest, including the fact that the drug dog did not properly alert. After negotiations with the Assistant United States Attorney (AUSA), the AUSA declined to file a complaint even though criminal charges were pending, and the DEA was forced to release the vehicle back to our client’s mother.

AUSA Returns Cryptocurrency After Forfeiture Complaint Filed

DEA seized over $30,000 worth of U.S. Dollar Tether (USDT) and Bitcoin. After receiving a “notice of seizure,” we filed a verified claim for court action. The AUSA filed a complaint in the U.S. District Court but then agreed to return the property before an answer became due. We entered a memorandum of agreement that ALL of the client’s cryptocurrency would be returned to the client’s wallet within fourteen (14) days. The funds were returned in April of 2023.

AUSA Agrees to Withdraw Seizure Warrant for Bitcoin and USDT in Binance Wallet

Our client’s Binance account was “frozen as it is currently under investigation by law enforcement.” We contacted the Special Agent with the Cyber Group of Homeland Security Investigations (HSI) and the Assistant United States Attorney (AUSA) assigned to the case. The AUSA obtained a seizure warrant but agreed to hold it pending negotiations.

Our client was accused of being an intermediary or a broker of funds stolen from victims of a liquidity mining pool scam in California. We requested a copy of the seizure warrant, supporting affidavit, and account records obtained from Binance. We presented several arguments for why the seizure warrant should be withdrawn, including:

- the U.S. District Court had no jurisdiction over the cryptocurrency funds seized for civil asset forfeiture;

- any accusation that Peer to Peer (P2P) trades constitute a “money transmitting business” was unjustified;

- the fraudulently obtained cryptocurrency was only in our client’s wallet for a short time, so the funds later frozen by Binance were not connected; and

- our client qualified as a “bona fide purchaser” who had no cause to believe that the property was subject to forfeiture.

Shortly thereafter, the AUSA thanked us for providing additional information and indicated that although they believed fraud proceeds were deposited into our client’s wallet, upon further review of our client’s transaction history and the arguments presented, they agreed to withdraw the seizure warrant by seeking the appropriate order from the issuing magistrate and promptly communicating any withdrawal order to Binance.

CBP Returns More than $10,000 Seized at the Fort Lauderdale International Airport

On 3/3/22, we received an email and letter from SAMANTHA J GAROFALO for Amelia Castelli, Director, Fines, Penalties and Forfeitures, Office of Field Operations, CBP, Miami, FL, in response to a verified claim we served on CBP on 11/5/21. The letter indicated that more than $10,000 in U.S. Currency seized at the Fort Lauderdale International Airport on September 09, 2021, by an agent with U.S. Customs and Border Protection (CBP) would be released to us via a check. CBP agreed to refund 100% of the money seized after the Assistant United States Attorney decided not to file a complaint in the U.S. District Court to litigate the forfeiture issue.

CBP Returns $22,000 Seized at Bradley International Airport, Windsor Locks, CT

On 1/20/22, we received notice from CBP that it was returning more than $22,000 seized from our client at the Bradley International Airport, Windsor Locks, in Hartford County, CT. We filed a verified claim for court action to bypass the administrative procedure for remission or mitigation. We also filed a demand to preserve the surveillance video and obtain the seizing agent’s investigation report from Homeland Security Investigations. Based on the report, we showed the AUSA several problems with the seizure, including:

- The K9 provided a “false positive” alert since no narcotics were found, and the agent didn’t bother to actually test for any trace narcotics on the currency before depositing the money into the bank.

- The amount seized is not a particularly large amount of U.S. Currency, especially for someone in our client’s position, given his income and net worth.

- TSA has no business monitoring and detaining passengers for carrying U.S. currency, especially for just over $28,000.

- The initial detention by TSA, which was illegal from its inception, was prolonged for an even longer period of time by the HSI agent as it attempted to gather enough highly circumstantial “evidence” to meet its interpretation of the probable cause standard.

- The seizing agent had no search warrant or legal basis to open the luggage or observe the money.

- No free and voluntary consent for the search was given under those circumstances.

- None of the client’s statements were actually contradictory. Instead, the agents kept asking the same questions over and over again.

- The client’s explanation that he intended to use the money to buy a vehicle was reasonable and supported by the evidence presented.

CBP Returns $14,802.00 Seized at the Fort Lauderdale International Airport

On August 16, 2021, we received a letter signed by Graciela B. Espinoza for Robert M. Del Toro, the Director of Fines, Penalties and Forfeitures at the U.S. CBP FPF Office, informing us that the $14,802.00 seized from our two clients before an international flight at the Fort Lauderdale International Airport on February 16, 2021, would be returned. The letter also provided: “The Government has decided to release the property to you.”

We filed a claim on April 12, 2021, which was signed by each client. The claim showed that $6,376 was seized from one client, and $8,426 was signed by the other client by a CBP Agent. The money was combined into one pile by CBP, who then issued only one receipt.

After being contacted by the Senior Attorney with the Office of the Associate Chief Counsel (Miami) for U.S. Customs and Border Protection, we argued that the CBP agents improperly combined the money. We also showed that CBP agents improperly alleged that our clients had more than $10,000 on an international flight after structuring the money to evade the reporting requirement pursuant to Title 31, United States Code, Section 5324 or the FinCEN 105 form by knowingly dividing the currency between themselves so that each was transporting less than $10,000 from a place inside the United States to a place outside of the United States.

CBP Returns $57,000 Seized at the Tampa International Airport

In January 2021, CBP seized $57,000 from a traveler at the Tampa International Airport. Before attempting to board a domestic flight, the traveler was detained and questioned near Gate A. Shortly thereafter, the traveler was escorted to the Tampa International Airport Police Station, where the detention continued for more than three hours. The traveler’s $57,000 was eventually seized, and the receipt listed an “undisclosed amount” of U.S. Currency.

Immediately after we were retained, we filed a claim for court action and preserved all video from Gate A and the police station. We convinced CBP to return all the $57,000.00 after showing problems with the legality of the warrantless search and prolonged detention.

FBI Returns $24,905.00 Seized for Forfeiture at the Airport in San Juan, Puerto Rico

On September 17, 2020, FBI agents seized $24,905.00 in United States Currency from our client at the Luis Munoz Marin International Airport in San Juan, Puerto Rico. According to the receipt, the money was seized for forfeiture pursuant to 21 U.S.C. 881. We filed a verified claim online on January 4, 2021.

The Assistant United States Attorney then waited 92 days to file a Verified Complaint for Forfeiture In Rem. After showing proof to the AUSA that the complaint was filed outside of the 90-day deadline imposed by CAFRA, the FBI agreed to return 100% of the money seized to our office. On May 6, 2021, the AUSA then filed a voluntary dismissal of the complaint with prejudice pursuant to Federal Rule of Civil Procedure 41(a)(1)(A)(i).

Keep in mind that you are not required to fill out a FinCEN Form 105 if you bring more than $10,000 cash into or out of Puerto Rico or the Luis Munoz Marin International Airport since it is not classified as “outside of the United States” or “a foreign country” for purposes of the reporting requirements (the same is true for the U.S. Virgin Islands, Guam, American Samoa, the Northern Mariana Islands, and Territory of the Pacific Islands).

Although you can carry over $10,000 cash on a flight to Puerto Rico or the U.S. Virgin Islands without needing to fill out a FinCEN Form 105, federal agents monitor individuals traveling to those locations more carefully, especially when they are suspected of transporting bulk currency.

CBP at DFW Airport to Return $30,830.00 After AUSA Files the Complaint

On October 18, 2020, an agent with Customs and Border Protection (CBP) seized $30,830.00 from our client at the Dallas/Ft. Worth (DFW) Airport. Before hiring our firm, the client attempted to file a pro se claim, but received correspondence from D.M. Nichols, Fines, Penalties & Forfeiture Officer and Paralegal Specialist Steven M. McGuirk at the Dallas/Ft. Worth Airport.

The letter claimed that the initial claim filed by the client on a pro se basis appeared to be “in conflict” about whether an administrative or judicial proceeding was being requested. After we were retained, we filed a second verified claim for court action on the client’s behalf, which CBP received on December 30, 2020.

More than 90 days later, the Assistant United States Attorney (AUSA) filed a complaint for forfeiture in the Dallas Division of the Northern District of Texas Dallas. We provided proof that the 90 day CAFRA deadline was missed. CPB agreed to return the money and the AUSA then filed a Motion for Voluntary Dismissal with prejudice pursuant to Fed. R. Civ. R. 41(a)(1)(A)(i). The motion explained:

“This dismissal is based on the untimely nature of the complaint, filed more than 90 days after an initial claim was made to Customs and Border Patrol for the $30,830 in question. Plaintiff has spoken with counsel for the Claimant of the $30,830 and understands there are no objections to this dismissal.”

DEA Seized +$78,000 at the JFK International Airport and Returned All of the Funds

In October 2020, DEA seized more than $78,000 from a traveler at the JFK International Airport. After we were retained, we took steps to preserve any surveillance video of the initial detention. After filing a verified claim for court action, a Senior Law Clerk with the Forfeiture Support Associates, LLC, contacted us to find out whether we would be amenable to a CAFRA extension to see if the case could be resolved prior to the filing of a complaint. We declined this invitation but provided information showing problems with how the initial detention occurred. We were then contacted by an Assistant United States Attorney (AUSA) with the Asset Forfeiture Unit in the Eastern District of New York. Ultimately, the AUSA failed to file the complaint within the 90 day deadline, and the funds were returned shortly thereafter.

DEA Seized $18,000 at the Jacksonville International Airport and Returned $18,000

In October 2020, the DEA seized $18,000 from a traveler at the Jacksonville International Airport. Shortly after being retained, we took steps to preserve the video of the initial detention from the JAA Internal Auditor. We then filed a verified claim for court action. After the Assistant United States Attorney failed to file a complaint for forfeiture within the 90 day deadline, all seized funds were returned in April of 2021.

DEA Seizes +$36,000 at the JFK Airport and Returns All of the Funds

In October 2020, a DEA Special Agent seized more than $36,000 from our client at the JFK International Airport. We took steps to preserve the video of our client’s initial detention by TSA at the checkpoint and later detention by DEA at the gate. After filing a verified claim for court action, we were contacted by an Assistant United States Attorney (AUSA) at the Asset Forfeiture Unit for the Eastern District of New York. After showing problems with the legality of the initial detention, the AUSA failed to file a complaint within the 90-day deadline, and the DEA returned the seized funds shortly thereafter.

DEA Returns $18,000 Seizure at Jacksonville International Airport

In October of 2020, DEA seized $18,000 at the Jacksonville International Airport. After requesting the video of the initial detention, we filed a verified claim for court action. On April 12, 2021, DEA agreed to return the funds. The money arrived at our office on April 28, 2021.

DEA Returns $47,000 Seized at the Newark Liberty International Airport

In September of 2020, DEA seized $47,000 from our client at the Newark Liberty International Airport. Shortly after we were retained, we took steps to preserve any surveillance video of the initial detention from the Port Authority. We then filed a verified claim for court action and provided information about problems with the legality of the initial detention. The Assistant United States Attorney decided not to file a complaint within the 90 day deadline. The funds were returned shortly thereafter.

CBP Seized $17,280 at the Orlando Airport and Returns $17,280

In September of 2020, agents with CBP seized $17,280 from a traveler at the Orlando International Airport. Shortly after we were retained, we preserved all of the surveillance videos of the initial detention from the Orlando Aviation Authority. After filing a verified claim, we presented information to CBP about the illegality of the initial detention, search, and seizure. The CBP ultimately decided to return all of the funds seized.

CBP Returns $17,000 of the $18,442.00 Seized at the San Ysidro Border Crossing

In September of 2020, CBP seized $18,442.00 at the San Ysidro Border Crossing near San Diego, California. Shortly after being retained, we filed a verified claim. Shortly after filing the claim, we were contacted by a Senior Attorney with CBP’s Office of Assistant Chief Counsel. Based on the documents we submitted, CBP’s Senior Attorney agreed that the circumstances justified a pre-civil settlement in which $17,000 would be refunded to our clients.

According to U.S. Customs and Border Protection (CBP) records, our clients, a husband and wife, were questioned as they were departing the United States at the San Ysidro Border Crossing. In response to being asked whether either was transporting more than $10,000 in U.S. currency or monetary instruments, each reported carrying $8,000. Upon further inspection, officers discovered a total of $18,442, which CBP claimed belonged to the husband. CBP alleged that the husband divided the money to avoid the currency reporting requirement.

The CBP officers claimed they didn’t need probable cause, nor reasonable suspicion to search persons, baggage, or conveyances crossing the international border for either inbound and outbound border crossings. The currency in this case was not seized with regard to its source and/or use. Rather, it was seized for non-compliance with 31 U.S.C. 5316, which requires an individual to report the transportation of currency over $10,000.00.

Willful failure to report the actual amount over $10,000 in currency is a crime punishable by up to five years in prison, a $250,000 fine, and forfeiture of the currency. (See 31 U.S.C. 5317 & 5322.) Dividing money among multiple travelers so that no single traveler is carrying more than $10,000, is in fact a separate crime commonly known as structuring, and is punishable by up to five years in prison, and a $250,000 fine. (See 31 U.S.C. 5324.)

Nevertheless, neither of our clients were charged with a crime and CBP agreed to return $17,000 to them on February 8, 2021, if they agreed to withdraw their requests that judicial forfeiture proceedings be commenced against the Currency. The balance of $1,442 was retained by the government as a payment in lieu of forfeiture.

CBP Returns $40,253 During Traffic Stop

In September of 2020, officers with the Brevard County Sheriff’s Office and agents with Customs and Border Protection (CBP) seized $40,253 in U.S. Currency discovered during a routine traffic stop and arrest on an outstanding warrant. After preserving video and audio from the roadside investigation and at the police station, we filed a verified claim for court action on October 20, 2020, which triggered the 90 day deadline for the Assistant United States Attorney (AUSA) to file a complaint in the U.S. District Court. Instead of filing the complaint, on February 2, 2021, we received a letter from CBP that indicated: “After a review of the matter, the Government has decided to release the property to you.”

CBP $48,660 Seized at the Orlando Airport and $48,660 was Returned 115 Days Later

On December 7, 2020, we received a letter from the Fines, Penalties and Forfeiture Officer concerning $48,660 in U.S. Currency that was seized at the Orlando Airport in September of 2020. The letter explains that “[a]fter review of the matter, the Government has decided to release the property to you.” The refund through direct deposit arrived on January 15, 2021.

In this case, we preserved surveillance video from the Orlando International Airport showing the problems with the detention from its inception. We also gathered all of the evidence showing why the funds came from a legitimate source and were intended for a legitimate purpose.

CBP Agrees to Return $13,522 after Seizing $13,522 in Detroit, MI

In July of 2020, CBP agents seized $13,522 from a husband and wife who were traveling together for an international flight out of the Detroit Metropolitan Airport. Normally, you do not need to declare on the FinCEN 105 form the amount of cash that you are bringing into or out of the United States on an international flight unless you are carrying more than $10,000.

Although neither of them had more than $10,000 in their possession, CBP seized the money after alleging that the husband and wife distributed the money between them with the intent to evade the currency reporting requirement of Title 31, United States Code, Section 5316. After filing the verified claim for court action and showing all of the reasons that the seizure was unjustified, on October 16, 2020, we learned that the AUSA decided not to file a complaint. The check arrived on November 19, 2020.

CBP Agrees to Release 100% of more than $40,000 Seized in Brevard County by ICE Agents

On November 9, 2020, we received a letter of “Judicial Forfeiture Declination” from Robert M. Del Toro, the Fines, Penalties & Forfeitures Officer with the Department of Homeland Security, U.S. Customs and Border Protection, Office Field Operations in Tampa, FL, regarding the seizure of more than $40,000.00 in U.S. Currency that U.S. Immigration and Customs Enforcement (ICE) seized in Brevard County, FL, after a routine traffic stop.

Immediately after the seizure, we filed a claim demanding court action and judicial referral. We also acted quickly to preserve video surveillance that showed problems with the way the money was seized. After a review of the matter, the Government decided to release the property instead of filing a complaint for forfeiture in the U.S. District Court.

$14,826 Seized by Homeland Security at the Dallas/Fort Worth (DFW) Airport and 100% Returned within 6 Months

On Tuesday, October 13, 2020, we received a letter from Paralegal Steven M. McGuirk on behalf of D.M. Nichols, Fines, Penalties and Forfeitures Officer at the U.S. Customs and Border Protection Office at 7501 Ester Blvd., Suite 160, Irving, TX 75063, that the “Government has decided to release the property to your client.”

A few days earlier, the Assistant U.S. Attorney with USAO-NDTX Asset Recovery, in Dallas, TX, told us that he “declined to pursue court action in the forfeiture case.” As a result, CBP was required to immediately return 100% of the $14,826 in U.S. Currency seized at the Dallas/Fort Worth Airport (DFW Airport).

Just a few weeks prior to that decision, the AUSA made an offer to return only $2,826 to our client with $12,000 being forfeited to the government. We quickly rejected that offer.

The seizure of currency by DEA at the Dallas/Fort Worth (DFW) Airport involved task force officers with the Drug Enforcement Administration (DEA) Homeland Security Investigations (HSI), HSI IRS Special agents, a DFW Police CID Detective, a Tarrant County Narcotics Detective, and/or K9 drug dogs. The law enforcement officers at the airport in Dallas/Fort Worth, TX, might report conducting “passenger interdiction as part of an ongoing bulk cash smuggling initiative” by making “consensual encounters with random individuals.”

But in many of these cases, a TSA agent secretly provides them with a tip that a traveler is carrying a large amount of U.S. currency. After reviewing the written reports generated during the investigation and gathering additional evidence, we provided the AUSA with all of the reasons that the initial detention was illegal.

The check for $14,826.00 arrived in our office on November 9, 2020.

$16,563 Seized by Homeland Security and $16,563 Returned within Four (4) Months

On November 27, 2019, before boarding an international flight out of the Tampa International Airport, an agent with U.S. Homeland Security Investigations (HSI) seized $16,563.00 from our client because the unreported currency was not listed on a FinCEN Form 105.

Although most of these types of seizures go unchallenged, our client found us by searching from his cell phone and contacted the firm while he was still at the airport after the seizure. We immediately preserved the airport surveillance video and filed a verified claim for court action to bypass any administrative proceeding.

On February 28, 2020, we received a letter from Robert M. Del Toro, the Fines, Penalties & Forfeitures Officer for the U.S. Customs and Border Protection (CBP) in Tampa, FL. The letter indicated that CBP received all of our correspondence regarding the seizure of $16,563.00 in U.S. Currency, including the demand for court action.

The letter indicated that “[a]fter a full review of the matter, it has been determined that the seized currency will be returned. Therefore, we have initiated a full refund which will be paid through the National Finance Center… You may expect this payment in approximately 2-3 weeks from the date of this letter.”

Most airports do not post adequate signs or make announcements about the currency reporting requirement for travelers departing the United States on an international flight. Even if the traveler somehow knew about the requirement, being able to comply would be onerous. As a result, seizures of unreported U.S. Currency not listed on the FinCEN Form 105 are common.

$159,950 Plus Interest Returned by Homeland Security

On September 20, 2019, $181,500.00 in U.S. Currency was seized at the Tampa International Airport before a domestic flight. A federal agent wrote a receipt to our client that said: “MONEY CONTAINED IN 2 BAGS. ESTIMATED VALUE IS 181,500.00.” However, only $159,950 was deposited into the bank after the seizure.

On September 26, 2019, we sent a claim via Certified Mail Return Receipt Requested to Fines, Penalties, & Forfeitures Officer, with the U.S. Customs and Border Protection in Tampa, FL., for the $181,500.00 in U.S. Currency.

Without acknowledging the claim, on October 9, 2019, Robert Del Toro, Fines, Penalties, & Forfeitures Officer with CBP send a notice of seizure claiming that only $159,950 has been seized. We filed a verified second claim for the funds listed in the “notice of seizure.”

After not reaching a resolution with the Assistant United States Attorney for the timely return of the funds, we file a lawsuit against CBP in federal court on January 31, 2020. We agree to voluntarily dismiss the lawsuit against CBP after it returned $159,950 and agreed to return an additional amount for interest in a second check.

Homeland Security Seizes $63,490.00 and Returned the Entire Amount After Filing a Complaint

In September of 2019, our client was detained at the Orlando International Airport (OIA). After finding $63,490 in U.S. currency in a checked bag, federal agents with the Department of Homeland Security seized the bag without a warrant. The agents then located our client who was boarding the domestic flight.

After being removed from the flight and enduring a prolonged detention, the client signed a “notice of abandonment and assent to forfeiture of prohibited or seized merchandise” form 4607 which was witnesses by a special agent with Homeland Security Investigations (HSI).

On October 11, 2019, we filed a claim for early judicial intervention or court action. The AUSA assigned to the case didn’t file the complaint until January 15, 2019. The verified complaint for forfeiture in rem alleged that the law enforcement officers seized the currency because there was probable cause to believe that the Defendant Funds constituted:

- Money furnished or intended to be furnished by a person in exchange for a controlled substance in violation of the Controlled Substances Act;

- Proceeds traceable to such an exchange; or

- Money used or intended to be used to facilitate a violation of the Controlled Substances Act.

After showing the AUSA our basis for having the case dismissed, the AUSA filed for Voluntary Dismissal which was granted on February 5, 2020. We received a check for the entire $63,490.00 on February 24, 2020, which was approximately 5 months after the seizure of cash from the Orlando International Airport.

U.S. Customs and Border Protection (CBP) Agrees to Return $45,001 after Airport Seizure of $45,001

On September 8, 2019, federal agents with the Department of Homeland Security (DHS) seized $45,001.00 in U.S. currency from our client’s luggage. We were contacted by a local attorney who took the case initially but wanted to be co-counsel with our law firm on the case.

The client signed an agreement to retain our firm under those terms. After completing our preliminary investigation, talking with the agent that seized the money, and preserving video surveillance of the incident, we filed a verified claim on September 30, 2019.

Our first verified claim letter demanded early judicial intervention (also called “court action”). We also provided additional information about the legality of the seizure and demanded that the case be forwarded to the United States Attorney’s Office to avoid any further delay.

Our first verified claim triggered the Fines, Penalties and Forfeiture Officer with the U.S. Customs and Board Protection to send the Notice of Seizure and Information to Claimants CAFRA Form, the Election of Proceedings CAFRA Form, and the Seized Asset Claim Form to us on October 4, 2019.

In response to those documents, we send a second demand for early judicial intervention (“court action”) on October 31, 2019.

Within 90 days of our first verified claim letter, we received a certified letter from the FP&F Officer. The letter explained: “The determination has been made that $45,001.00 will be remitted.” The check for $45,001.00 arrived on February 7, 2020.

DEA Seizes $52,620 and Agrees to a Full Refund 6 Months Later

On October 30, 2018, DEA seized $52,620.00 at the Fort Lauderdale-Hollywood International Airport in Broward County, FL, from our client. We immediately filed a claim to contest the forfeiture in the United States District Court pursuant to 18 U.S.C. Section 983, et. seq, 19 U.S.C. Sections 1602-1619, Title 21 CFR Sections 1316.71-1316.81.

On February 6, 2019, we receive a letter from the DEA’s Office of Operations Management of the Asset Forfeiture Section acknowledging that it received the submission of the claim. The claim was accepted and the matter was referred to the United States Attorney for the Civil Division in the Southern District of Florida.

After sending various financial documents to the AUSA assigned to the case, we were able to show a legitimate source of the funds. We also provided information about technical and procedural problems that impacted the AUSA being able to file a complaint.

On April 22, 2019, we received a letter informing us of the “decision to return” the entire $52,620.

CBP Returns $30,000 after $30,000 in U.S. Currency Seized at Tampa International Airport

On December 12, 2018, agents with U.S. Customs and Border Protection (CBP) seized $30,000 in cash at the Tampa International Airport from our client without providing a receipt. A few days later we requested a receipt showing that $30,000 had been taken.

The authorities confirmed that an undetermined amount of currency was seized but claimed it had not yet been counted. Eventually we were provided with a receipt from CBP which correctly listed the total of $30,000 in U.S. Currency being seized.

Shortly after the seizure, we preserved the airport surveillance video of the agents who conducted the initial interrogation, search, and seizure. Because part of the detention of the seized cash occurred at the Tampa International Airport Police Department (TIAPD), we also preserved the surveillance video of that part of the detention.

On January 1, 2019, we created an election of proceedings form and verified CAFRA seized asset claim to trigger the case be forwarded to the U.S. Attorney’s Office for early judicial action.

We received a letter dated March 16, 2019, from the Fines, Penalties and Forfeitures Officer for U.S. Customs and Border Protection which indicated that “[a]fter a full review of this matter, our office determined that the currency will be returned to your client. Therefore, $30,000 in U.S. currency will be returned to [your client] within three to four weeks.”

We agreed to complete a CAFRA Hold Harmless Release Agreement in consideration for the return of all of the property. The form required our client to forever release the United States from any claim in connection with the detention, seizure, and/or release by U.S. Customs and Border Protection of the above-listed property.

The agreement also required our client to waive any claim to attorney’s fees, interest, or any other relief not specifically provided for in the agreement. We finally received the check for $30,000 on April 19, 2019.

$30,000.00 Seized by DEA at the Airport and $29,375.89 Refunded

On April 14, 2018, several DEA agents seized $30,000 in cash from our client. Immediately after the seizure, the DEA issued our client a “receipt for cash or other items” which listed an “undetermined amount of US Currency.” The DEA agents then sealed the cash in a bag and took it to the bank to be deposited.

On June 7, 2018, the DEA send our client a “notice of seizure of property and initiation of administrative forfeiture proceedings” which described the property as $29,000 in U.S. Currency. $1,000 went missing.

On July 11, 2018, we send via “federal express priority overnight” a claim to contest the forfeiture of the property in U.S. District Court (a request for immediate judicial action). Our claim forced the DEA to stop the administrative forfeiture proceeding and forward the case to the U.S. Attorney’s Office for further proceedings.

Because of several problems that we pointed out, the U.S. Attorney’s Office refused to take any action in the case. Shortly thereafter, we received a letter dated November 15, 2018, from the Senior Attorney with the Asset Forfeiture Section of the DEA informing us of the decision “to return” the $29,000. We competed the UFMS Vendor Request Form as requested.

On December 20, 2018, we received the check for $29,375.89.

DEA seized $13,260 Cash at the Orlando International Airport and $13,260 Returned

On June 13, 2018, DEA seized $13,260 from our client at the Orlando International Airport. That same amount was deposited into the bank by the DEA agents. After we were retained in the case, we submitted a packet of information including a verified claim for judicial court action before the deadline on August 28, 2018.

On September 20, 2018, Merri L. Hankins, Senior Attorney for the DEA’s Asset Forfeiture Section wrote us a letter informing us of the decision to return the $13,260 in U.S. Currency.

$13,227 Seized by ICE HSI and $11,892 Returned

U.S. Currency was seized from our client at the Tampa International Airport. The receipt provided to the client by Homeland Security Investigations (“HSI”) Special Agent (“SA”) Carlos Carrasquillo indicated that “$13,227” had been seized and the currency was counted in the client’s presence before the receipt was written. Nevertheless, only $11,892 was actually deposited into the bank by ICE HSI agents.

We immediately filed a verified demand for early judicial court action and complained about the missing money. Shortly thereafter, we received a letter from Mary Ann Cranford, with the title “Fines, Penalties, & Forfeitures Officer” at the U.S. Customs and Board Protection Office in Tampa dated April 6, 2016.

The letter indicated that Mary Ann Cranford had received our verified claim demanding the immediate return of funds taken by Homeland Security Investigations (“HSI”) Special Agent (“SA”) Carlos Carrasquillo at the Tampa International Airport.

The letter advised that the U.S. Attorney’s Office has chosen not to file a forfeiture action in Court. The letter stated: “Accordingly, this office will submit a request to the National Finance Center to issue a refund in the amount of $11,892” which was the total amount presented to the CBP office after the seizure.

This article was last updated on Wednesday, March 20, 2024.