In January 2021, CBP seized $57,000 from a traveler at the Tampa International Airport. Before attempting to board a domestic flight, the traveler was detained and questioned near Gate A. Shortly thereafter, the traveler was escorted to the Tampa International Airport Police Station, where the detention continued for more than three hours. The traveler’s $57,000 was eventually seized, and the receipt listed an “undisclosed amount” of U.S. Currency.

Immediately after we were retained, we filed a claim for court action and preserved all video from Gate A and the police station. We convinced CBP to return all the $57,000.00 after showing problems with the legality of the warrantless search and prolonged detention.

On August 16, 2021, we received a letter signed by Graciela B. Espinoza for Robert M. Del Toro, the Director of Fines, Penalties and Forfeitures at the U.S. CBP FPF Office, informing us that the $14,802.00 seized from our two clients before an international flight at the Fort Lauderdale International Airport on February 16, 2021, would be returned. The letter also provided: “The Government has decided to release the property to you.”

We filed a claim on April 12, 2021, which was signed by each client. The claim showed that $6,376 was seized from one client, and $8,426 was signed by the other client by a CBP Agent. The money was combined into one pile by CBP, who then issued only one receipt.

After being contacted by the Senior Attorney with the Office of the Associate Chief Counsel (Miami) for U.S. Customs and Border Protection, we argued that the CBP agents improperly combined the money. We also showed that CBP agents improperly alleged that our clients had more than $10,000 on an international flight after structuring the money to evade the reporting requirement pursuant to Title 31, United States Code, Section 5324 or the FinCEN 105 form by knowingly dividing the currency between themselves so that each was transporting less than $10,000 from a place inside the United States to a place outside of the United States.

On 1/20/22, we received notice from CBP that it was returning more than $22,000 seized from our client at the Bradley International Airport, Windsor Locks, in Hartford County, CT. We filed a verified claim for court action to bypass the administrative procedure for remission or mitigation. We also filed a demand to preserve the surveillance video and obtain the seizing agent’s investigation report from Homeland Security Investigations. Based on the report, we showed the AUSA several problems with the seizure, including:

- The K9 provided a “false positive” alert since no narcotics were found, and the agent didn’t bother to actually test for any trace narcotics on the currency before depositing the money into the bank.

- The amount seized is not a particularly large amount of U.S. Currency, especially for someone in our client’s position, given his income and net worth.

- TSA has no business monitoring and detaining passengers for carrying U.S. currency, especially for just over $28,000.

- The initial detention by TSA, which was illegal from its inception, was prolonged for an even longer period of time by the HSI agent as it attempted to gather enough highly circumstantial “evidence” to meet its interpretation of the probable cause standard.

- The seizing agent had no search warrant or legal basis to open the luggage or observe the money.

- No free and voluntary consent for the search was given under those circumstances.

- None of the client’s statements were actually contradictory. Instead, the agents kept asking the same questions over and over again.

- The client’s explanation that he intended to use the money to buy a vehicle was reasonable and supported by the evidence presented.

On 3/3/22, we received an email and letter from SAMANTHA J GAROFALO for Amelia Castelli, Director, Fines, Penalties and Forfeitures, Office of Field Operations, CBP, Miami, FL, in response to a verified claim we served on CBP on 11/5/21. The letter indicated that more than $10,000 in U.S. Currency seized at the Fort Lauderdale International Airport on September 09, 2021, by an agent with U.S. Customs and Border Protection (CBP) would be released to us via a check. CBP agreed to refund 100% of the money seized after the Assistant United States Attorney decided not to file a complaint in the U.S. District Court to litigate the forfeiture issue.

Our client’s Binance account was “frozen as it is currently under investigation by law enforcement.” We contacted the Special Agent with the Cyber Group of Homeland Security Investigations (HSI) and the Assistant United States Attorney (AUSA) assigned to the case. The AUSA obtained a seizure warrant but agreed to hold it pending negotiations.

Our client was accused of being an intermediary or a broker of funds stolen from victims of a liquidity mining pool scam in California. We requested a copy of the seizure warrant, supporting affidavit, and account records obtained from Binance. We presented several arguments for why the seizure warrant should be withdrawn, including:

- the U.S. District Court had no jurisdiction over the cryptocurrency funds seized for civil asset forfeiture;

- any accusation that Peer to Peer (P2P) trades constitute a “money transmitting business” was unjustified;

- the fraudulently obtained cryptocurrency was only in our client’s wallet for a short time, so the funds later frozen by Binance were not connected; and

- our client qualified as a “bona fide purchaser” who had no cause to believe that the property was subject to forfeiture.

Shortly thereafter, the AUSA thanked us for providing additional information and indicated that although they believed fraud proceeds were deposited into our client’s wallet, upon further review of our client’s transaction history and the arguments presented, they agreed to withdraw the seizure warrant by seeking the appropriate order from the issuing magistrate and promptly communicating any withdrawal order to Binance.

DEA seized over $30,000 worth of U.S. Dollar Tether (USDT) and Bitcoin. After receiving a “notice of seizure,” we filed a verified claim for court action. The AUSA filed a complaint in the U.S. District Court but then agreed to return the property before an answer became due. We entered a memorandum of agreement that ALL of the client’s cryptocurrency would be returned to the client’s wallet within fourteen (14) days. The funds were returned in April of 2023.

On September 8, 2023, a 2014 Mercedes-Benz G550 was seized by the Drug Enforcement Administration (DEA) during a routine traffic stop, alleging a violation of 21 USC 881, along with violations of other federal laws, including 19 U.S.C. §§ 1602-1619, 18 U.S.C. § 983 and 28 C.F.R. Parts 8 and 9. On behalf of the client, Sammis Law Firm filed a claim for court action with DEA. We presented arguments regarding an illegal stop, detention, and arrest, including the fact that the drug dog did not properly alert. After negotiations with the Assistant United States Attorney (AUSA), the AUSA declined to file a complaint even though criminal charges were pending, and the DEA was forced to release the vehicle back to our client’s mother.

On November 2, 2023, the Honorable Michael Robinson, a Circuit Court Judge in Broward County, signed an order finding “no probable cause” for the seizure and forfeiture of a 2020 Dodge Challenger after an adversarial hearing held on October 30, 2023. The order required the agency to return the vehicle to our client within five (5) business days. Additionally, the order found that since there was no probable cause, the Hollywood Police Department, pursuant to Section 932.704(10), was ordered to reimburse the client for the reasonable attorney fees paid to our firm.

On February 6, 2024, more than $20,000 in U.S. Currency was seized for forfeiture at the Jacksonville International Airport. The client hired us the next day. On February 8, 2024, we sent a preservation letter and public record request to the Department of Aviation Security or Internal Auditor at the Jacksonville Aviation Authority (JAA). The letter was to obtain any airport surveillance video showing our client’s initial detention before he was moved to an interrogation room where his luggage was searched and his money was seized. The client also reported that the DEA task force officer seized his cell phone and attempted to delete a video he had taken during his initial detention.

Instead of releasing the surveillance video, the Internal Auditor at JAA forwarded our request to Bradley A. Boyle, Group Supervisor, DEA Jacksonville District Office. Possibly because they didn’t want the video released, the seizing agents indicated they might be willing to release the money if we provided additional documents. We were later contacted by Special Agent John Hollingsworth, DEA Jacksonville District Office, who requested our client sign a DEA-48 (Disposition of Non-Drug Evidence) and Secured Party Indemnity Agreement. That agreement falsely claimed the money had been used in violation of Title 21 of the United States Code. It included a “hold harmless” provision that would have protected DEA from further liability. That proposed agreement also contained language that would have precluded any innocent owner/lienholder defenses if the money were seized again.

When we refused to sign those documents, we received an email from Merri Hankins, Senior Attorney in DEA’s Asset Forfeiture Section, who clarified that “DEA is attempting to return your client’s funds per a procedure referred to as ‘quick release’ found in 28 CFR 8.7.” The quick release was approved even though we had already filed a premature claim on the client’s behalf with DEA on February 20, 2024.

After some negotiation, DEA allowed the client to retrieve all of his money from the sealed evidence bag on March 1, 2024, without signing any of the agreements prepared by DEA.

On April 10, 2024, we received a letter from Robert M. Del Toro, Fines, Penalties and Forfeiture Officer, signed by Rebecca Gabbard, CBP Paralegal Specialist, explaining that our client’s 1992 Land Rover Defender 110, imported from South Africa, seized on 9/20/23, was being returned. The letter explained that the “Government has decided to release the property to you and return the cost bond.” The letter gave further instructions on picking up the vehicle from a government-contracted facility where it was being held. Before receiving this letter, we filed a non-CAFRA claim for court action, posted the cash bond, and negotiated with the Assistant United States Attorney (AUSA) while explaining why CBP’s allegations were wrong. Ultimately, the AUSA refused to file a complaint in the U.S. District Court, forcing CBP to release the vehicle immediately.

Court Finds No Probable Cause for Seizure by Lake County Sheriff’s Office – Leslie Sammis represented two clients (the company that loaded money into an ATM and the bank that supplied the money to the company). In that case, the Lake County Sheriff’s Office seized $42,423,00 in U.S. Currency from one ATM and $89,407 from another ATM. After an Adversarial Preliminary Hearing held on October 4, 2024, the Court reviewed exhibits, watched a video of the seizure, and listened to the testimony of several witnesses. In an order dated October 4, 2024, Circuit Court Judge Dan R. Mosley found that the Lake County Sheriff’s Office had “no probable cause” to seize the currency found in the ATMs. The property was returned to Ms. Sammis’ clients shortly thereafter.

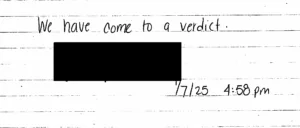

On January 6-7, 2025, Attorney Leslie Sammis took a civil asset forfeiture case to trial in federal court before the Honorable Judge Thomas Barber. The Drug Enforcement Administration (DEA) seized $41,805.00 and about $30,000 in gold jewelry. The property was seized in Manatee County during the execution of a search warrant at our client’s home in late 2021. The case was stayed while the criminal charges were pending. The two-day trial happened on Monday and Tuesday. The jury checked all 9 boxes, “No,” which means the government must return all seized property. It was a total and complete victory.

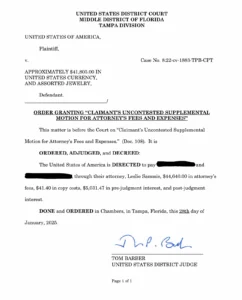

On January 28, 2025, the Court signed an order directing the government to pay the Claimants, through their attorney Leslie Sammis, $44,640.00 in attorney’s fees, $41.40 in copy costs, $5,031.47 in pre-judgment interest, and post-judgment interest. The U.S.A. was required to pay all the Claimant’s reasonable attorney fees, which is mandatory under the Civil Asset Forfeiture Reform Act of 2000 (CAFRA). The mandatory attorney fees provisions are intended to discourage overzealous Government actions in forfeiture cases.