Blockchain Law

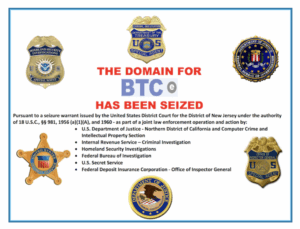

Blockchain Law and Civil Asset Forfeiture “Blockchain law” refers to the emerging legal field addressing the legal, regulatory, and policy issues arising from the use of blockchain technology, digital assets (like cryptocurrencies and stablecoins), and smart contracts. Blockchain law has become an increasingly important area of practice as government agencies expand their use of seizure […]