FinCEN Form 105

Before bringing $10,000 in cash to the airport for an international flight, read this article explaining why federal law requires you to file the FinCEN Form 105 (called the “Report of International Transportation of Currency or Monetary Instruments” (CMIR)).

Failure to properly disclose bringing more than $10,000 on an international flight might result in federal agents with Customs and Border Protection (CBP) or Homeland Security Investigations (HSI) seizing the money in a civil asset forfeiture proceeding.

If your money was seized at the airport, attorney Leslie Sammis could help you contest the forfeiture by filing a verified claim demanding court action. Filing the verified claim is the ONLY way to challenge the legality of the seizure with the goal of getting 100% of the money returned quickly.

We can help you file the claim for court action immediately after the seizure. In other words, you do not have to wait 60 days for the “notice of seizure” letter from CBP to arrive in the mail.

Read more about our case results in civil asset forfeiture cases.

Attorneys for Seizures with FinCEN Form 105

If you are taking an international flight with more than $10,000 in cash, be aware that agents with Homeland Security Investigations (HSI) and Customs and Border Protection (CPB) might seize the money for a civil asset forfeiture proceeding.

If your money was seized by HSI or CBP because you failed to disclose the money on the FinCEN 105 cash declaration form, then contact attorney Leslie Sammis about contesting the seizure by filing a verified claim for court action. The claim demands that the government return 100% of the money.

We can explain why the administrative procedures for remission, mitigation, or an offer in compromise, typically cause a long delay and do NOT work.

The only way to contest the legality of the seizure of the U.S. Currency at the airport is to file a verified claim demanding that CBP forward the claim to an Assistant United States Attorney (AUSA). Filing the claim triggers a 90-day deadline for the AUSA to either return the money or file a “complaint for forfeiture” in the district court.

Filing the claim for often forces the agency to return the funds within 90 days because the AUSA might decide not to file a complaint in court. If the AUSA files a complaint in federal court, we can protect your rights during every stage of the process. We represent clients throughout Florida and the United States.

Although many of these cases occur at the airport before or after an international flight, seizures for failure to report on the FinCEN Form 105 can occur at other ports of entry.

Call 813-250-0500.

What Happens If You File a Verified Claim for Court Action?

After a seizure of cash at the airport, we help our clients file a verified claim for court action. Shortly after we file the claim for court action, we often receive a call from the forfeiture attorney at U.S. Customs and Border Protection (CBP) asking if we want to make an “offer in compromise.”

We answer that question by saying:

“No. My client and I filed the verified claim because we are 100% sure we want to bypass any administrative proceeding. We’d like you to go ahead and refer the case to the AUSA without any further delay.”

We also explain in writing all of the problems with the legality of the detention and seizure. When the federal agent fails to follow the proper policies and procedures, we point that out as well. In some cases, we show the legitimate source of the funds to counter any allegation that the money was involved in drug trafficking, money laundering, or fraud.

By filing the demand for court action, it triggers a 90-day deadline for CBP to turn the case over to the Assistant United States Attorney (AUSA). The AUSA then has to either return the money or file a complaint in the U.S. District Court.

If a complaint for forfeiture is filed within the 90 days, then we can represent you during the litigation and protect your rights during each stage of the proceeding.

Allegations of Structuring $10,000 in Cash to Evade Reporting Requirements

Even if you have less than $10,000 in cash in your possession, if you are traveling with family members or anyone else, and you and your traveling companions are collectively carrying more than $10,000 in cash total, then you need to file the FinCEN Form 105.

Filing the form correctly helps you avoid any allegation of structuring the $10,000 in cash to evade the reporting requirements pursuant to Title 31, United States Code, Section 5324.

CBP will often allege that the travelers did, with the intent to evade the currency reporting requirement of Title 31, United States Code, Section 5316, knowingly divided the defendant currency between themselves so that each was transporting less than $10,000 from a place inside the United States to a place outside of the United States.

In most cases, these rules have a “gotcha effect” that penalizes people that didn’t understand the confusing rules. Customs agents sometimes take unfair advantage of travelers in order to seize their money for forfeiture.

Who Must File the FinCEN Form 105?

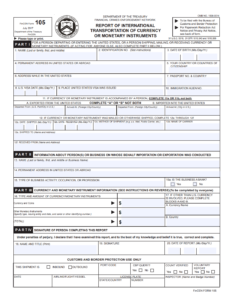

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the U.S. Department of the Treasury. FinCEN requires the following people to fill out the 2021 FinCEN Form 105 as required by 31 U.S.C. 5316 and Treasury Department regulations (31 CFR Chapter X):

- Any person who “physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an aggregate amount exceeding $10,000 at one time from the United States to any place outside the United States or into the United States from any place outside the United States….”

- Any person who “receives in the United States currency or other monetary instruments in an aggregate amount exceeding $10,000 at one time which has been transported, mailed, or shipped to the person from any place outside the United States.”

A transfer of funds through normal banking procedures which does not involve the physical transportation of currency or monetary instruments is not required to be reported.

Is the FinCEN 105 Cash Declaration Form Reported to the IRS?

We are often asked questions about whether the cash declaration form or the FinCEN Form 105 is reported to the IRS. What happens when you declare money at customs?

The short answer is that that the form might be accessed by the IRS or law enforcement agencies. In fact, the back of the FinCEN 105 Form explains that the principal purpose for collecting the information is to “assure maintenance of reports or records where such reports or records have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings.”

The back of the form also explains that information collected may be provided to “those officers and employees of the Bureau of Customs and Border Protection and any other constituent unit of the Department of the Treasury who have a need for the records in the performance of their duties.”

Furthermore, the record may be referred to “any other department or agency of the Federal Government upon the request of the head of such department or agency.”

Additionally, the information collected on the FinCEN 105 form may also be provided to “appropriate state, local, and foreign criminal law enforcement and regulatory personnel in the performance of their official duties.”

This means that the IRS has access to the information disclosed on the form and can use that information during an audit or investigation into tax fraud. Furthermore, the information revealed on the FinCEN form might trigger significant legal and international tax implications and consequences.

So if you need to bring more than $10,000 into or out of the United States, then talk with a tax attorney about the information disclosed on the FinCEN form 105. A tax attorney can explain any legal or tax consequences so that appropriate remedial actions can be taken in a timely manner.

When and Where to File the FinCEN Form 105

Any traveler or traveling companions carrying currency or other monetary instruments must file the FinCEN Form 105 at the time of entry into the United States or at the time of departure from the United States with the Customs officer in charge at any Customs port of entry or departure.

An additional report of a particular transportation, mailing, or shipping of currency or monetary instruments is not required if a complete and truthful report has already been filed. No person otherwise required to file a report, however, will be excused from liability for failure to do so if, in fact, a complete and truthful report has not been filed.

Forms may be obtained from any Bureau of Customs and Border Protection (CBP) office or by visiting the links listed below.

Definitions on the FinCEN Form 105

For purposes of the requirement to file the FinCEN Form 105 when traveling outside of the United States with more than $10,000 in U.S. Currency or monetary instruments, you should understand the most commonly used terms.

For instance, the term “currency” is defined as the coin and paper money of the United States or any other country that is designated as legal tender, circulates, and is customarily accepted as a medium of exchange in the country of issuance.

For purposes of the FinCEN Form 105, the term “monetary instruments” is defined to include the following:

- coin or currency of the United States or of any other country;

- traveler’s checks in any form;

- negotiable instruments (including checks, promissory notes, and money orders) in bearer form, endorsed without restriction, made out to a fictitious payee, or otherwise in such form that title thereto passes upon delivery;

- incomplete instruments (including checks, promissory notes, and money orders) that are signed but on which the name of the payee has been omitted; and

- securities or stock in bearer form or otherwise in such form that title thereto passes upon delivery.

The term “monetary instruments” is defined not to include any of the following:

- checks or money orders made payable to the order of a named person which have not been endorsed or which bear restrictive endorsements;

- warehouse receipts; or

- bills of lading.

What are the Consequences of Failing to Report U.S. Currency on the FinCEN Form 105?

As explained in this article, any amount of U.S. Currency or other monetary instruments valued at $10,000 or more must be disclosed when entering or leaving the United States pursuant to 31 U.S.C. 5316 and 31 CFR Chapter X.

So what are the consequences of failing to report having more than $10,000 on the FinCEN 105? Failure to provide all or any part of the requested information may subject the currency or monetary instruments to seizure and forfeiture, as well as subject the individual to civil and criminal liabilities.

Bring more than $10,000 on an international flight could result in civil penalties, including a fine of not more than $500,000 and imprisonment of not more than ten (10) years, for any of the following:

- the failure to file a report;

- filing a report containing a material omission or misstatement; or

- filing a false or fraudulent report.

As a practical matter, crimes related to bringing more than ten thousand dollars on an international flight are rarely prosecuted.

Exceptions to Reporting Requirements of the FinCEN Form 105

The law also provides for several exceptions to the general rules that the FinCEN Form 105 must be filed for the following entities:

- a Federal Reserve bank

- a bank, a foreign bank, or a broker or dealer in securities in respect to currency or other monetary instruments mailed or shipped through the postal service or by common carrier

- a commercial bank or trust company organized under the laws of any State or of the United States with respect to overland shipments of currency or monetary instruments shipped to or received from an established customer maintaining a deposit relationship with the bank, in amounts which the bank may reasonably conclude do not exceed amounts commensurate with the customary conduct of the business, industry, or profession of the customer concerned

- a person who is not a citizen or resident of the United States in respect to currency or other monetary instruments mailed or shipped from abroad to a bank or broker or dealer in securities through the postal service or by common carrier

- a common carrier of passengers in respect to currency or other monetary instruments in the possession of its passengers

- a common carrier of goods in respect to shipments of currency or monetary instruments not declared to be such by the shipper

- a travelers’ check issuer or its agent in respect to the transportation of travelers’ checks prior to their delivery to selling agents for eventual sale to the public

- a person with a restrictively endorsed traveler’s check that is in the collection and reconciliation process after the traveler’s check has been negotiated, nor by

- a person engaged as a business in the transportation of currency, monetary instruments, and other commercial papers with respect to the transportation of currency or other monetary instruments overland between established offices of banks or brokers or dealers in securities and foreign persons.

Do I have to Declare Gold at Customs?

When arriving in or departing from the United States, does a traveler have to declare gold at Customs? Gold isn’t generally included within the definition of “currency.”

The FINCEN’s definition of currency, however, would include gold coins of any country if it is (1) designated as legal tender, (2) that circulates; and (3) that is customarily accepted as a medium of exchange in the country of issuance.

For this reason, the website of U.S. Customs and Border Protection (CBP) explains why travelers must declare carrying Gold coins, medals, and bullion into or out of the United States. U.S. law provides restrictions for bringing into the United States gold or gold items from Sudan, Iran, or Cuba.

Although there is no duty on gold coins, medals, or bullion, these items must still be declared to a Customs and Border Protection (CBP) Officer if valued at more than $10,000 on the FinCEN 105 form.

Read more – Do I have to declare gold at Customs?

Other Circumstances Requiring Reporting on the FinCEN Form 105

Each person who receives currency or other monetary instruments in the United States must file FinCEN Form 105, within 15 days after receipt of the currency or monetary instruments, with the Customs officer in charge at any port of entry or departure or by mail.

For any shippers or mailers, if the currency or other monetary instrument does not accompany the person entering or departing the United States, FinCEN Form 105 may be filed by mail on or before the date of entry, departure, mailing, or shipping addressed to:

Attn: CMIR

Passenger Systems Directorate #1256

CBP

7375 Boston Blvd.

DHS, VA 20598-1256

Additional Resources

IRS Publications on FinCEN Form 105 – Visit the IRS Tax Map to find information on the FinCEN Form 105. The links include Publication 519, a U.S. Tax Guide for Aliens with filing information. Find out when the FinCEN Form 105 is sent to the IRS during an investigation into tax fraud or money laundering.

FinCEN 105 form (2020 version) – Find an easy-to-use printable PDF template with both an English and Spanish version of the FinCEN 105. Find other forms created by the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) including FinCEN Form 104, 112, 114, and Form 6059b.

This article was last updated on Friday, January 14, 2022.